WHAT TO DO WHEN A MEMBER IS PAST DUE

INTRODUCTION

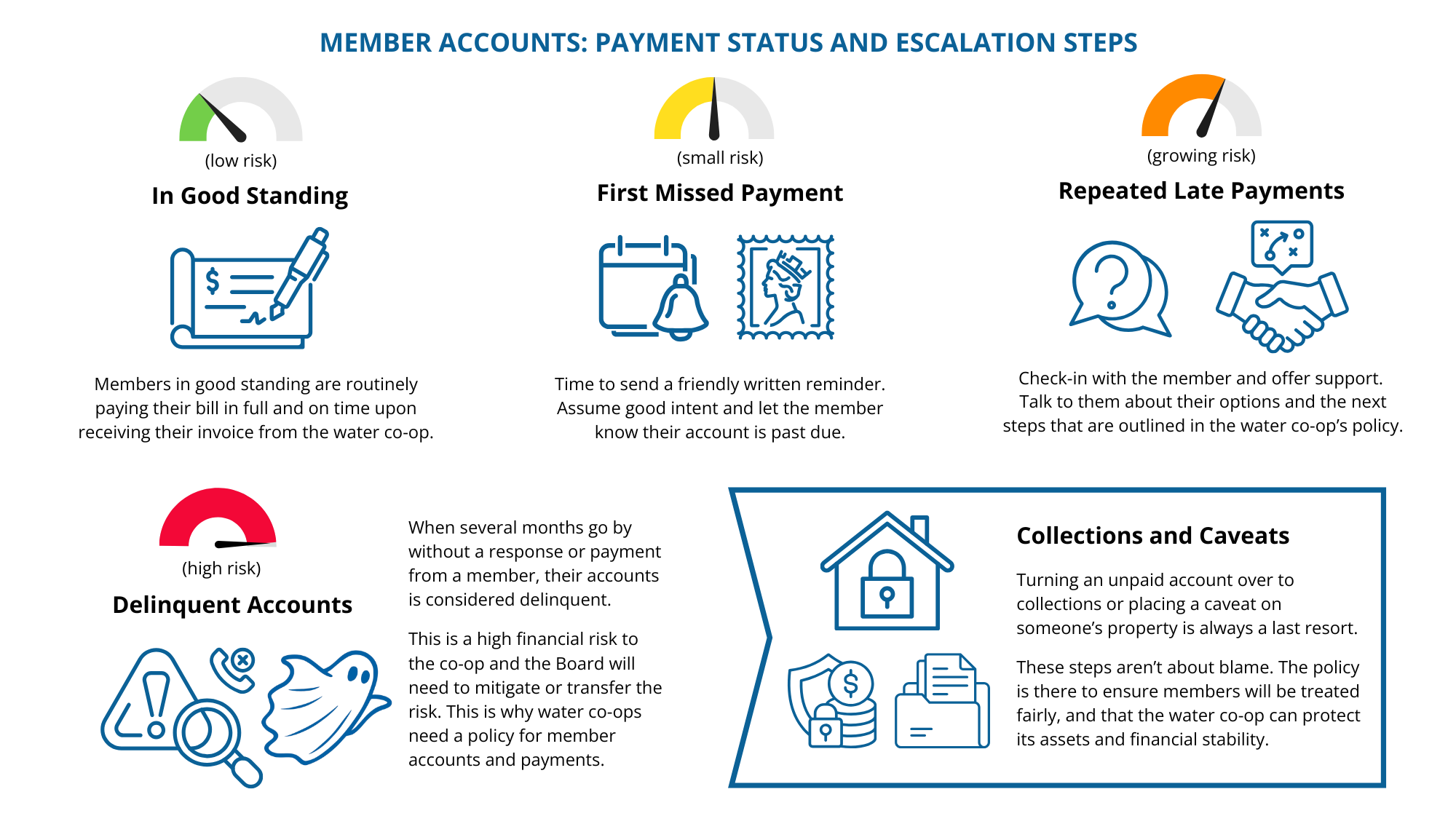

Rural water co- ops have to handle their members' money (and financial circumstances) with care, while keeping the long- term well- being of the water co- op in mind.

Written policies and good record keeping are foundational to demonstrating integrity and transparency within rural water co- ops.

Policies and procedures create a consistent framework for decision- making. While the Board is responsible for upholding policies and procedures, they also need to regularly review and update them, while remembering that the policies belong to everyone in the water co- op. They are there to ensure that volunteer directors, staff and members understand their roles and responsibilities and are treated fairly.

Written records show what decisions were made, and how, when and why those decisions were made. Capturing key details for clarity, context and understanding not only ensures accountability, it can provide the water co- op with valuable insight it can learn and improve from.

Keep this in mind, as your water co- op responds to members who are late with their payments.

When every reasonable effort has been made to collect payment directly from members, the water co- op may need to take formal steps to recover the debt and protect its financial position. Policy, procedure, and process must be followed consistently and documented.

Formal Steps may include but are not limited to:

- Registering a caveat on the property.

- Turning off the curbstop and/or removing the meter and putting a lock on.

- Hiring a collection agency.

- Deeming a member "Not in Good Standing" using the co- ops Collection Policy.

- Filing a claim in Civil Court.

The water co- op has an option to file a caveat on the land title to secure the unpaid amount. A caveat is a legal notice registered with Alberta Land Titles that signals the rural utility's interest in the property until the debt is settled. It does not transfer ownership, but it prevents the property from being sold or refinanced without addressing the outstanding balance. Water co- ops can file caveats through a partnership with the Federation of Alberta Gas Co- ops (FedGas).

Many water co- ops have curbstops (CCs) installed at the property line for each service. Water coops that bill based on consumption will have meters installed. When the co- op has exhausted other methods to collect, they should consider shutting off the CC and/or removing the meter at that member's property. Due process must be followed and documented.

Turning an account over to a collection agency is another option. The agency pursues repayment on the co- op's behalf. The collections agency works under a formal agreement with the water co- op and willikely charge a significant fee or a percentage of what is recovered. This step can only be taken if it fits into the policy and after the member has received proper notice, had a fair opportunity to make payment arrangements, and the Board has approved the escalation

Many water co- ops have a set of criteria that would identify a member as "Not in Good Standing" that can be used during the collection process. Once a member has that status a set of conditions must happen for them to return to the "Member in Good Standing" status.

Civil court claims are used to get a judgement for settlement of the member's account. The information bulletin on this topic is posted on the website.

MEMBER AGREEMENTS AND WATER CO-OP POLICIES

The consumer contract between your water co- op and each member will need to have a section for water rates and payment expectations. This section of the agreement will include the date and frequency of bill payments and what the member's penalties are for late and missed payments.

There's another section in the consumer contract called encumbrance. This section explains to the member that defaulting on their account (falling behind on payments) may lead to a Caveat being placed on the title of their property, if the water co- op is unable to collect the money it is owed.

While consumer contracts with members are essential, the water co- op also needs specific policies in place for handling member accounts, disputes, late payments, collections, etc.

It might seem obvious, but the water co- op must treat members fairly and apply all the policies to all the members, equally.

Regardless of how large or small your water co- op is, policies are necessary for consistent decision- making. Policies ensure due- process and accountability to help the Board uphold the best interests of the water co- op in the moment and into the future.

The types of policies your water co- op may consider implementing (or reviewing and updating) could include:

- Membership and Member Service Policy

- Complaint and Dispute Resolution Policy

- Billing and Payments Policy

- Overdue Accounts and Collection Policy

- Late Payments and Collections Policy

- Confidentiality and Member Records Policy

- Financial Transparency and Reporting Policy

- Member Communication and Transparency Policy

Having good governance policies in place can help save the Board and the members from escalating frustrations or false accusations when times get tough.

Here's a draft policy framework for collecting on overdue accounts that your water co- op can edit and build on if needed:

Policy Title: Overdue Accounts and Collections Policy

Applies To: All members, Directors, and authorized representatives acting on behalf of the water co- op to manage member billing, payments and recovering outstanding balances

Approved: Board of Directors on [Date]

Policy Statement: [Name of Your] Water Co- op is committed to handling unpaid accounts fairly, respectfully, legally, and consistently across the membership. Our goal is to protect both our members and our water co- op's long- term financial stability. Serious actions toward recovering our water co- op's financial losses (through collections or caveats) are taken only as a last resort.

This policy provides a clear process for how the water co- op will consistently follow up on overdue accounts. This policy guides the conduct of both co- op members and authorized representatives of the water co- op, insisting on clear, considerate, two- way communication between a member and the co- op when their account is past due.

Guiding Principles:

- Fairness and Consistency: All members are treated equally and according to the same process and timelines

- Transparency: Our water co- op proactively informs and educates members about the responsibilities of membership, payment expectations and due dates, and the potential consequences of non- payment.

- Confidentiality: Our water co- op handles members' financial circumstances discreetly and only shares the information it needs to, with the fewest number of people who need to know.

- Collective Responsibility: Protecting the water co- op's financial well- being ensures reliable service and fairness to all members of the water co- op. We understand that at times members may have difficulty keeping up with their payments. At the same time, every member's contribution is what keeps our rural water system running safely and reliably for everyone.

- Communication: Every reasonable effort will be undertaken to make contact with the member and collaboratively resolve financial matters, before the water co- op takes formal or legal action.

Roles and Responsibilities

| Role | Responsibilities |

| Manager/Operator (if there are no staff, this work may be divided among the Treasurer and Secretary) |

→ Issues invoices to members and monitors payments → Sends reminders, late notices, and other correspondence → Maintains secure records of all communications and payments to the member's account → Provides updates to the Treasurer on accounts in arrears, and has the authority to make a payment plan offer to qualifying members in accordance with this policy |

| Treasurer | → Oversees billing, payment tracking and financial reporting → Reviews/reports to the Board on overdue accounts, and flags any escalating risks and accounts becoming delinquent → Coordinates collection or legal process if/once approved |

| Board Chair/Vice Chair | → Ensures the right level of detail is being reported to the Board (respecting member privacy as much as possible, taking matters in camera where appropriate, etc.) → Supports the Operator/Treasurer with enforcing the policy → Leads (or delegates) the communication for sensitive and serious matters |

| Board of Directors | → Approves and regularly reviews this policy and upholds fairness, compliance and oversight → Receives reporting that summarizes delinquent accounts → Approves decisions to refer an account to collections or to file a caveat on the member's property |

Confidentiality and Documentation:

Member account information is confidential and shared only with those directly responsible for managing the account and making related decisions. All communication, notices and payment plans will be documented and stored securely.

Monitoring and Reporting:

The Treasurer will provide the Board with reporting on outstanding balances owed to the water co- op and the status of delinquent accounts at least quarterly. The Board will review trends in chronic delinquency and assess if policies and payment terms need to be updated. Annually, the Board will discuss bad debts, write- offs, collection results and lessons learned.

TIMELINES AND COLLECTION PROCESS

| Stage | Days Past Due | Best Practices and Considerations |

| Reminder (Late Payment) |

1 - 30 days | A written reminder (email or mail) is sent to the member 15 days past the due date. The water co-op calls the member to check in. A late fee may apply (if allowed in the water co-op’s policy). |

| Notice: Overdue Account (Second Missed Payment) |

31 - 60 days | A second written reminder is sent to the member on day 31 if their outstanding balance is not paid with their next invoice. This will be the first demand letter. On day 45, if the account is still behind on payments, the water co-op reaches out to the member (first by phone) to determine what’s going on. A follow up communication (written) will be sent to the member summarizing the discussion and next steps. |

| Repeated Late Payments (Arrangements Required) | 61 - 90 days | When a member’s account is more than 60 days past due and the water co-op has not been able to talk to the member, another demand letter must be sent with a reminder that continued non-payment could lead to restricted access to services or even legal action. If the member has made sporadic attempts to reconcile the outstanding balance on their account, the water co-op can work on establishing payment arrangements (if allowed in the water co-op’s policy). |

| Final Notice (Pre-Collection) | 91 - 120 days | A final notice/demand letter must be sent to members who are more than 90 days past due. The Board Treasurer will know if there is a payment plan in place, if there is not, the member has 30 more days to reach an agreement with the co-op before they lose service and the matter is escalated by sending the account to external collections and/or a filing a land title caveat. |

| Delinquent | 120+ days | At this stage, the water co-op must take action to protect its financial stability. The Board reviews the steps taken (following the policy framework) to reach the member and work with them on a solution, and then determines if the file should be transferred to collections, if the co-op should seek legal counsel, or if a caveat will be filed. |

COMMUNICATION TOUCHPOINTS FOR MEMBER ACCOUNTS

Every consumer contract, member agreement, and policy offers multiple communication touchpoints between the member- owner and the water co- op. That means multiple opportunities to educate members about being more than consumers of a rural utility. With the benefits and democratic rights of member- ownership, come some duties and responsibilities.

Taking a proactive approach to communicating with members and engaging them on a regular basis will help the water co- op establish mutually beneficial relationships. Lay the groundwork for good communication and member- minded solutions.

If the first/only time you reach out to a member is when they're being warned about impending consequences or threatened with discipline, the water co- op can risk creating that sensation of calling the member into the principal's office. Naturally, a member will feel defensive, guarded, maybe embarrassed or ashamed. A member who feels that way is going to be more difficult to communicate with and won't be in the mindset to collaborate and problem solve.

| Experience | Actions | Communications |

| Onboarding Member Application and Consumer/ Member Agreements |

·Member applies to join the water co-op, submits all documents, and is approved by the Board ·Their membership agreement is signed and their account is set-up with the water co-op |

Welcome package to the member within a week of membership approval, explaining how billing works, the member's payment options, due dates, rate and connection information, and the water co-op's history, policies on dispute resolution and payments |

| First Billing Cycle | ·The member's account and water meter is active ·The member receives their first bill for water usage |

First invoice could include an insert that explains water usage, service charges, due date and payment information along with contact information for the co-op |

| Ongoing Operations Regular Billing |

·The water co-op is receiving and reconciling payments regularly ·Bills to members are generated at a steady and predictable frequency (monthly, quarterly, annually) |

Invoices are sent to all members at a steady frequency. The water co-op can share short updates with members (maybe through statement inserts or the occasional email newsletter) |

| First Late Payment | ·It has been 30 days since the due date of the last water bill and the member hasn't paid ·Late accounts should be flagged for the bookkeeper, treasurer or staff who handles payments and accounts ·A representative from the water co-op should reach out privately and respectfully to the member |

A written reminder will be sent to the member (by mail or email) and the water co-op may also consider making a courtesy call Keep a neutral tone, “We noticed your payment hasn't come through yet” and document the outreach and communication process along the way |

| Repeated Late Payments | ·The member has missed more than two consecutive bill payments and has not been in contact with the water co-op ·The Board Treasurer's report includes the number of member accounts in arrears |

Once reminders have gone out, if members have not contacted the co-op and payments continue to be missed, it's time to send a demand letter. The goal is for the member to respond so the co-op can gather facts and help find solutions. |

While demand letters are a necessary step in the collection process, remember that the first objective is to establish two- way communication between the member and co- op.

With open communication, the water co- op is able to start fact finding. Your rural water co- op wants to find out if the member expects that their hardships are short- term (like waiting for a cheque) or something more disruptive in the long- term (like illness or job loss).

| Experience | Actions | Communications |

| Member Hardship | ·The member and an authorized representative from the water co-op are working together to get the account back on track ·The water co-op demonstrates a true willingness to work with the member through their hardship, which may include educating members about additional resources available to them (like rural or social assistance grants, Alberta Works or municipality) |

Communicate using neutral terms like "outstanding balance" rather than words like "delinquent" The goal is to come to agreement on payment installments, methods and dates (within policy) Follow up with a confirmation letter summarizing the plan and next steps, and expressing appreciation to the member along with the co-op's commitment to confidentiality and privacy |

| Payment Plan | ·The member's payment arrangements have been accepted, the water co-op Board receives reporting in summary only (no personal details) ·If payments continue to be missed, reminders are sent and inquiries are made with the member to determine if this requires escalation |

Follow up communications in this stage should be proactive and kind, more neighbourly check-ins, less collection agency type calls. The Board needs to know the number of accounts and balance of amounts owing to the water co-op, but members' privacy must be respected, especially in rural member-owned utilities |

| Member is Avoiding Responsibilities | ·If more than 90 days have gone by without any payment or communication, the water co-op needs to take action to protect its financial stability | Another demand letter needs to be sent along with a disconnection warning, while the water co-op diligently follows policy and documents the steps taken to contact the member. |

Every water co- op sets their own billing schedules and timeline for member payments.

The timelines and processes for managing accounts must be applied consistently to all members, regardless of the tenure of their membership, their status in the community, etc.

The water co- op needs to hold members accountable to their member agreements, which can only be done through proper communication and documentation. This is part of the Director's duty of care.

MONITORING AND REPORTING

To effectively provide financial oversight of the water co- op, the Board needs to routinely monitor the status of member accounts, while respecting the privacy of each individual member.

MONTHLY MONITORING

- Treasurer or bookkeeper reviews the accounts receivable aging report

- Overdue accounts are identified by age category (30, 60, 90, 120+ days)

- Flag accounts nearing escalation and track trends and challenges

QUARTERLY BOARD REPORTING

- Board reviews a summary report showing outstanding balances, number and value of accounts in each overdue/age category, and actions taken (reminders, arrangements, caveats, etc.)

- Board assesses and discusses any recurring issues or trends

BOARD OVERSIGHT

- Board reviews chronic delinquency trends to determine whether policies or payment terms need updating

- Board annually reviews write- offs, collection results, bad debts and lessons learned

DOCUMENTATION

- All correspondence and call notes are retained with the member's account records

- All payment plans must be in writing and signed by both parties, and contain the details of the payment schedule, including amounts, due dates and payment method