THE BUDGETING AND FINANCIAL PLANNING PROCESS

Let’s look at the budgeting process step-by-step, and get a sense of the kinds of questions Directors can ask to gain insight and become confident in their financial accountability.

At the end of the budgeting process, the Board should have a roadmap for how the water co-op will provide reliable operations to members, invest in the future, and prepare for the unexpected.

WHO DOES WHAT?

The Board of Directors as a collective will be responsible for setting financial priorities, drafting and monitoring the budget, and communicating with members.

The Board Chair needs to keep the process moving and ensure that key decisions are recorded (usually by the Secretary) in the Board’s meeting minutes.

The Treasurer/Secretary-Treasurer usually takes the lead on coordinating the numbers. They also build in assumptions (like adjusting for inflation and expecting insurance and labour costs to go up) and they will likely take the lead on explaining the financial statements to the Board and the members.

If the water co-op has a manager or administrator, they may be included in preparing the budget and tracking the actual expenses throughout the year. Otherwise, this work will also fall to the Treasurer and the Board.

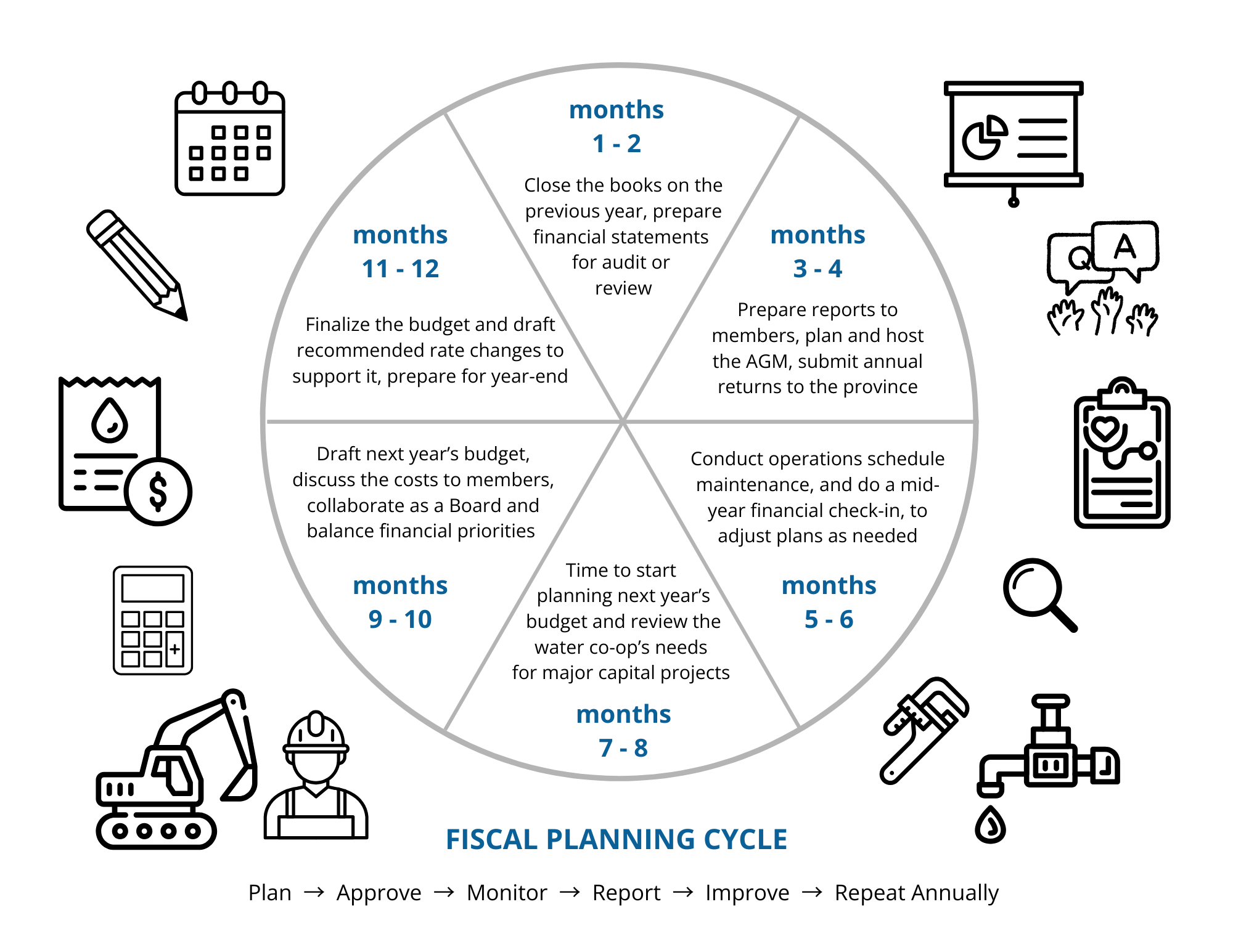

PLANNING AT A GLANCE

There are many ways to approach financial planning and for the Board to work through the annual budgeting process. To make the workload more manageable, consider completing the steps over multiple Board meetings.

By breaking the budgeting process down into phases, the Board can bring greater clarity and focus to each financial discussion. With some reflection time in between, Directors have the chance to ask more questions and gather more information between meetings to make better informed decisions.

The basic steps in the budgeting process are:

- Agree on who does what, and when

- Gather facts to know where you stand before you plan

- Agree on realistic financial assumptions about the year ahead

- Figure out how to fund the day-to-day and the upkeep

- See the large projects that are coming up and spread costs sensibly

- Put together the whole picture for the year (budget and cash-flow)

- Review risks and stress test the budget to make sure it meets needs

- Relook at the draft budget and spend time fine-tuning it as a Board

- Reduce surprises to members by having a communications plan

- Get the approval you need from the members to operate under the budget

- Monitor finances, maintain financial reports and adjust spending/budget as needed

- Close the books at year-end and present financial statements to members within 120 days

A well-paced process can help build credibility with members. When the Board treats budgeting as a thoughtful and methodical process, it shows members that their money is being carefully managed.

As volunteer and member-driven organizations, rural water co-ops should try to embrace a financial planning process that creates less stress and more buy-in.

If your Board meets monthly, the following pages offer a meeting schedule and step-by-step guide that might work well for your water co-op. Download the Template - Planning Budget Meetings to customize the work plan to suit the pace and needs at your water co-op.

KICK-OFF AND PRIORITIES

Once you pass the half-way mark in your water co-op’s current fiscal year, it will be time to start planning the next year ahead.

REVIEW CURRENT AND PAST BUDGET PERFORMANCE

- Look at the actual income and expenses of the previous full year where complete financial statements are available

- Review the actual vs. planned spending of the current fiscal year to date

- Discuss financial realities, challenges, lessons learned and recent successes

IDENTIFY PRIORITIES AND GOALS FOR THE YEAR AHEAD

- Discuss upcoming needs for operations, maintenance, multi-year projects

- Discuss high-level goals for the year and set financial and strategic priorities

ESTABLISH TIMELINES AND ASSIGN ROLES

- Clarify who will prepare the numbers for the year ahead and do any research needed for the Board to draft a good budget

- Adopt a simple Board calendar with meeting dates and decision deadlines

DURING THIS STAGE, DIRECTORS MIGHT ASK

- What lessons did we learn last year that should guide this year’s plan?

- Were there surprises in last year’s spending or revenue? What costs seem to be increasing?

- Are there projects we’ve postponed that can’t wait any longer?

- How does this current year’s budget connect to our long-term needs and vision?

- Who is responsible for preparing and revising the draft budget for the upcoming year?

- What information do they need from the Board (and/or Operator) before they can start?

- What decisions need to be made by the Board vs the membership? When will we need to approve the final version to present at the AGM?

THE PRELIMINARY BUDGET

REVIEWING REVENUE AND EXPENSES

- Review the first draft budget prepared by the Treasurer (or Operator)

- Review projected revenues (member payments)

- Review core costs (utilities, staffing, insurance, admin)

- Anticipate inflation or cost-of-living adjustments if there are employees

IDENTIFY CAPITAL PROJECTS AND MAINTENANCE NEEDS

- Review upcoming infrastructure replacements, upgrades, or emergency reserves

- Flag any big-ticket capital projects for this year or future years

- Assess the water co-op’s maintenance needs

- Ask questions, understand impacts to members, and suggest adjustments

DURING THIS STAGE, DIRECTORS MIGHT ASK

- How predictable are our regular expenses, and where might costs rise unexpectedly?

- How much of our operation and admin work is being done by paid staff vs volunteers?

- What is the true cost of our operations, if we had to replace volunteers?

- What condition is our infrastructure and equipment in? What capital projects are urgent?

- Do we have any emergency reserves if something major breaks?

TESTING THE BUDGET

BUILD IN RESERVES

- Decide how much to set aside for future needs

- Balance immediate spending with long-term stability

TEST SCENARIOS

- What if revenue is lower than expected?

- What if a project comes in over budget?

- Use “what if” models to stress-test the draft

COMPARE

- Look at past budgets, compare the forecasted numbers to past years’ spending trends

- Consider industry norms or regulatory expectations

- Dig deeper into line items: Are cost estimates realistic? Are reserves being funded properly?

DURING THIS STAGE, DIRECTORS MIGHT ASK

- Do we have a target for how much money we need to keep in reserve funds?

- Are we setting aside enough to handle an emergency or future upgrades?

- What have we contributed to reserves over the last 3-5 years?

- How do this year’s proposed numbers compare to our past budgets?

- Which parts of our budget are flexible, and which are non-negotiable?

- Are we being realistic about what we can manage with volunteer capacity?

- What if our volunteers or operator needs to work extra hours for emergency repairs?

- How would we respond if more members than usual fall behind on payments?

- Do our spending priorities line up with what we told members we’d focus on?

FINAL REVIEW AND MEMBER IMPACT

MEMBER IMPACT

- Will rates to members need to change?

- Does the budget reflect fair and transparent financial stewardship?

STRATEGIC DIRECTION

- How does this budget support the water co-op’s mission and vision?

- Achieve consensus as a Board that the financial choices match the stated priorities

DURING THIS STAGE, DIRECTORS MIGHT ASK

- Will rates or fees need to change to balance the budget? How can we clearly explain those changes to members? How will we support members if higher rates create hardship?

- Are we balancing short-term needs with long-term sustainability?

- Are we setting realistic expectations for what we can accomplish this year?

- Has the full Board had a chance to understand and agree on what’s being proposed?

- Does this budget reflect our water co-op’s values and long-term vision?

COMMUNICATION AND APPROVAL

PRESENT THE BUDGET AND GET MEMBER SUPPORT

- Present the year-end financials and the upcoming year’s budget to the membership for approval at the AGM

- Prepare a simple but clear explanation for members, especially if rates are changing

- Acknowledge the effort it took to get here and shared success!

DURING THIS STAGE, DIRECTORS MIGHT ASK

- How will we present the budget at the AGM so members can easily understand it?

- Have we shown how member payments directly support operations, maintenance, and reserves?

- What key messages should the Chair or Treasurer emphasize when presenting? How will we handle questions or concerns respectfully and clearly?

- What have we learned recently that can improve next year’s process?

SUMMARY

Walk through the process, step by step. Try to spread the work across several meetings and a few different volunteers so it doesn’t all fall on the Treasurer. Test “what if” scenarios.

Your Board can build a budget that is realistic and transparent. Download the Template - Planning Budget Meetings to help your water co-op Board organize the budget planning process.

Remember to:

- Think short and long term

- Be proactive, not reactive

- Keep members in mind

- Stay flexible

A good budget gives the rural water co-op stability today and tomorrow. It’s one of the most powerful tools your Board has to serve members well.