WHY BUDGETING MATTERS

Budgeting is a bit more than revenue and expenses. Consider the budget a decision-making tool that helps the Board set priorities for the water co-op.

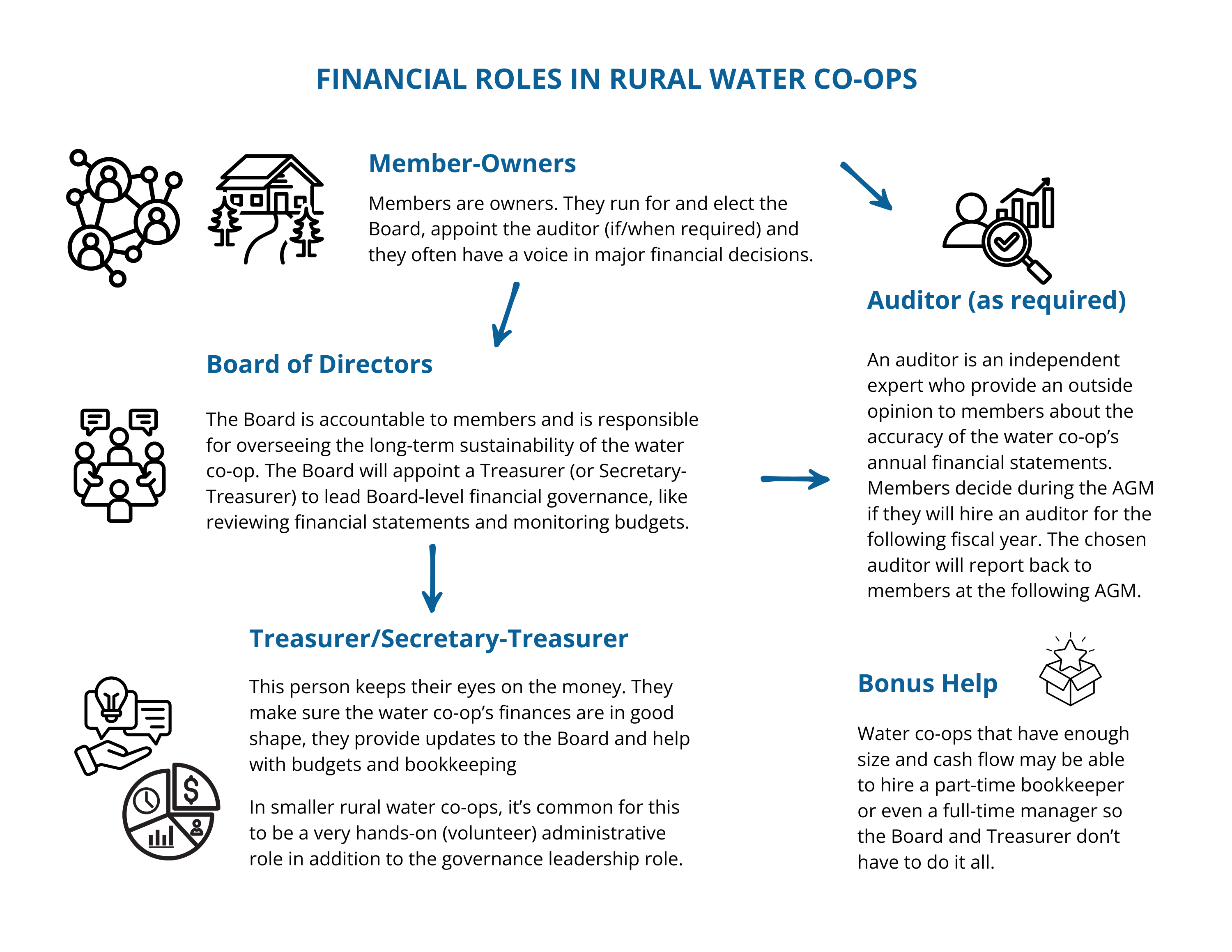

The Treasurer acts as the Board’s financial point person, but they are not solely responsible for the water co-op’s budget or finances. The Board is responsible for safeguarding the financial health of the water co-op.

All directors must understand the basics, ask good questions, and keep the members’ needs and best interests at the heart of their financial decision making. A Board that actively monitors finances is better equipped to respond quickly when there are emergencies or opportunities for improvement.

To understand the full scope of responsibilities, review the information bulletin: Finance - Overview of Responsibilities.

BUILDING BLOCKS OF A BUDGET

The budget for a water co-op is usually developed annually and reviewed on a quarterly or monthly basis.

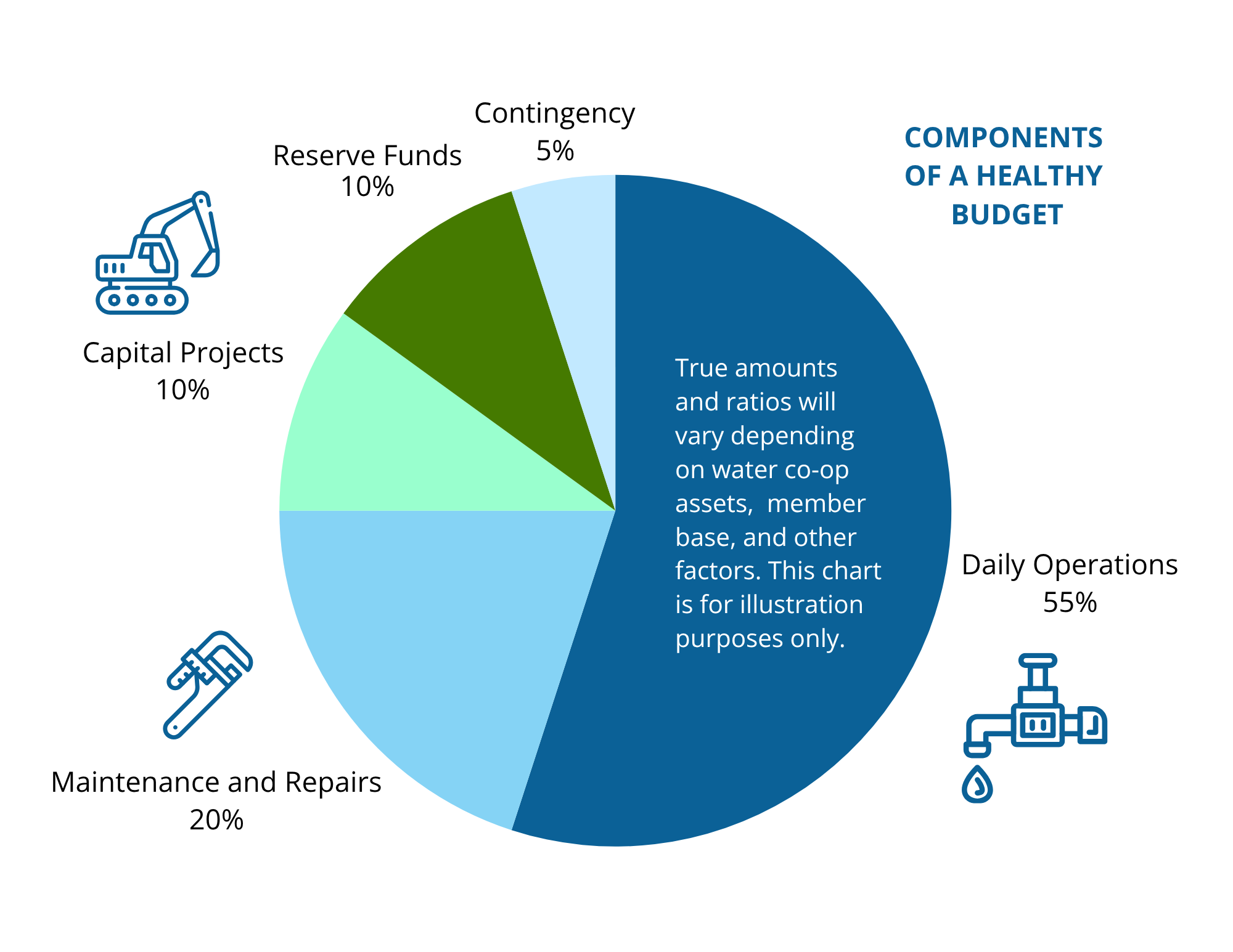

The budget outlines the basic financial plan for operations, maintenance, capital projects and reserves. The Board should also plan for a bit of a financial cushion, often called contingency.

OPERATIONS

- The day-to-day costs of keeping the water flowing to members

- Examples: electricity, insurance, inspection and testing supplies, staff wages

Operations are the backbone of every budget. Operational expenses are all the costs needed to keep the water co-op functioning on a daily basis. Typically, there is historical data of past years’ expenses that can be adjusted for inflation and used to plan the upcoming budget.

MAINTENANCE

- Regular upkeep of equipment, systems, and water co-op infrastructure

- Examples: water line repairs, pump servicing, replacing worn parts

- Preventative maintenance reduces costly breakdowns later

Maintenance will help protect the investment members have made in their water co-op. A strong maintenance plan will help extend the life of the rural utility’s assets.

Part of the Board’s annual planning should include budgeting for maintenance, and scheduling it. Many water co-ops find it helpful to maintain a maintenance log or schedule. This kind of tracking tool supports both budgeting and regulatory reporting.

Maintenance may not come cheap, but in the long-run, preventative care is almost always more affordable than an emergency fix.

This will likely lead to a bigger conversation on capital projects.

CAPITAL PROJECTS

- Big-ticket or longer-term investments for the water co-op

- Examples: upgrading facilities, major equipment purchases

Capital projects are the big investments rural water co-ops make in their infrastructure and future. It can take years to save for a capital project. In most cases, rural water co-ops will also need to share the cost of capital projects across the membership by doing a cash call.

RESERVES

- Funds set aside for capital projects, emergencies, or other future needs

Reserve funds are kept separate from the water co-op’s regular bank account. The water co-op Board may choose a guaranteed investment certificate (GIC) or high interest savings account, or whatever banking product they deem most suitable.

REGULATIONS SAY

All directors should know the Rural Utilities Regulations about the requirements for reserve funds for rural utility co-operatives in Alberta.

Reserves are your water co-op’s safety net, and the regulator says we all need them.

These funds need to be separate from operating funds and must be used for a specific purpose like replacing major infrastructure or responding to an unforeseen emergency.

[Rural Utilities Regulations, Dec. 2024]

In this budgeting information bulletin, we touch on the topic of reserves at a high level. See the information bulletin: Finance - Reserve Funds to learn more about reserves, including further details about the legal requirements and regulations.

RESERVE FUND BASICS FOR BUDGETING

When building the budget, the Board has to answer the question: “What are we doing to build reserves this year?”

CONTRIBUTIONS

Decide how much to set aside for reserves this year. Try to treat contributions to reserves as a non-negotiable line item in the budget (just like paying bills). The water co-op needs to set money aside for stability and long-term sustainability.

PURPOSES

What will the water co-op need in the future? Discuss goals and needs around replacing aging infrastructure or responding to emergencies. Keep in mind, these types of reserve funds need to be separate from contingency funds the rural water co-op may need to draw on if there is an unexpected drop in revenue or rise in operational costs.

BALANCE

The Board will need to compare current reserve levels to upcoming capital needs. It is prudent to ensure the water co-op’s reserve fund will cover the cost of an unplanned failure of the most expensive piece of equipment you have (including replacement and contingency operating costs).

RULES

Have reserve funds. Keep them in a separate savings account. Only use them for approved purposes. In addition to having a bank account for conducting the operational business of the water co-op, there should also be an interest bearing account set-up for reserve funds.

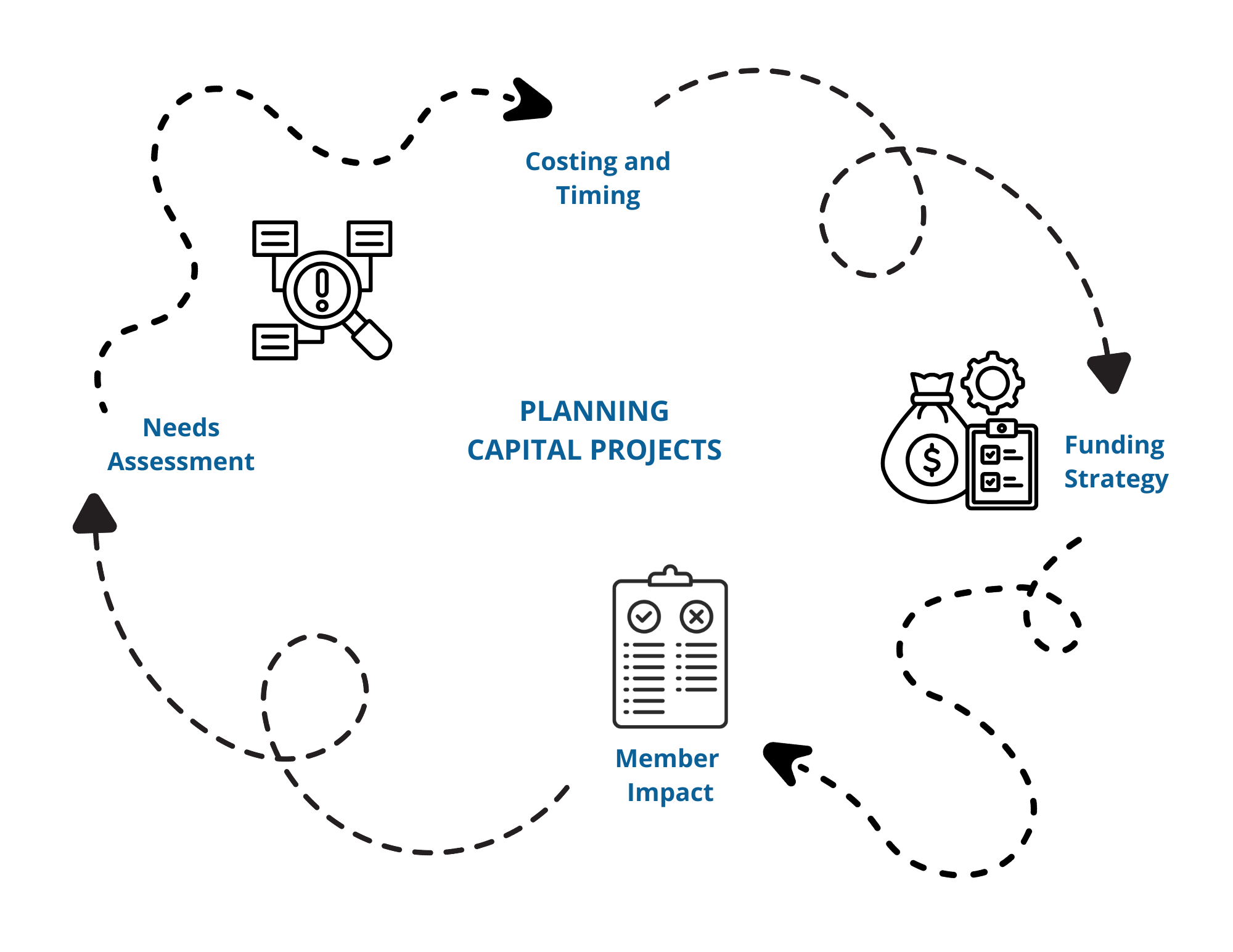

PLANNING FOR CAPITAL PROJECTS

Your rural water co-op is owned by the members, which means every member is going to contribute to the water co-op’s capital projects.

The Board will do its best to plan for capital projects in advance, but sometimes things happen and infrastructure needs replacing sooner than expected.

When water co-ops have routine inspection and maintenance schedules, and know the condition of their equipment and infrastructure, they can better forecast when big ticket items will need an upgrade.

NEEDS ASSESSMENT

What growth, regulatory, or service issues are driving our need for capital?

What major assets are nearing the end of their lifespan?

Your water co-op can retain an engineering firm with expertise in asset management to conduct the study or do it internally if resources are available. The reserve fund study won’t be exact, but it will certainly put the co-op in a better position to manage future expenditures.

COSTING AND TIMING

The Board (or Operator) can contact suppliers and contractors to gather estimates for the projects that will be needed in the future. Then the Board will have information to help decide what projects will happen in the upcoming year and what can be phased out over several years.

FUNDING STRATEGY

During the budgeting process the Board will figure out what portion of this year’s capital projects can be funded directly from existing reserves. The Treasurer and Board can figure out the estimated cost to members, and recommendations on how to accumulate the funds required for the project(s).

Whenever possible, surplus funds (net income at the end of the year) should be moved to reserves for long-term investments in the water co-op.

MEMBER IMPACT

The water co-op will need to communicate to members about why this investment is necessary and how the capital project will benefit the membership. Be prepared to provide members with information about how the project can impact service quality, reliability and member wallets.

BUILDING A BALANCED BUDGET

A budget is the financial roadmap for the year. Building it means:

- Listing revenues

(mostly member payments, plus any secondary income) - Estimating expenses

(operations, maintenance, capital projects, and reserves) - Balancing the numbers so revenues and expenses align

(no hidden gaps, no unrealistic expectations)

Running a planned surplus allows the water co-op to grow reserves or get ahead of future capital costs. The key is transparency: every dollar should have a purpose members can understand.

For a step-by-step guide on building the budget, see the information bulletin called Finance - The Board’s Guide to the Budgeting Process.

APPROVING AND AMENDING THE BUDGET

Once drafted, the Budget is approved by the Board through a motion at a Board meeting. Approval signals that the Board has reviewed it, asked their questions, and believe it serves the water co-op’s needs and members fairly. The Budget is then presented to the membership at the AGM.

Budgets are plans, not predictions.

If circumstances change, the Board can amend the budget. Amending doesn’t mean the first plan was wrong; it means the Board is prudently managing the water co-op’s finances as operating conditions shift.

If the need arises for a major expense or cash call to members, that needs to be voted on by the membership.