INTRODUCTION TO FINANCIAL GOVERNANCE

When members can trust that their Board is financially competent and transparent, they are more likely to support budgets, rate adjustments, and long-term infrastructure plans.

The Board is responsible for safeguarding the financial health of the water co-op. All directors must understand the basics, ask good questions, and keep the members’ needs and best interests at the heart of their financial decision making. Directors must be mindful of any perceived or real financial conflicts of interest, and declare them to the Board. This will help protect the volunteer director and the water co-op.

DEFINING FINANCIAL GOVERNANCE

In simple terms, financial governance means knowing where the money comes from, where it goes, and who’s responsible for making decisions about it.

When financial governance is done well, it protects the water co-op’s ability to deliver services to members today and for years to come. If it’s done poorly, it can lead to service disruptions, financial losses, or even legal trouble.

A GOVERNANCE BOARD

A governance board focuses on oversight and direction. Their job is to ensure the water co-op is financially stable and operating according to its bylaws, policies, and co-operative principles. Governance boards usually delegate the day-to-day work like bookkeeping and maintenance to employees, contractors, or an Operations Manager.

A governance board’s main tools are:

- Policies (to set expectations)

- Budgets (to allocate resources)

- Reports (to monitor progress)

When a water co-op has someone to manage operations, the Board’s job is to stay out of the weeds but provide oversight, making sure the work is being done properly, safely, and within budget.

AN OPERATIONAL BOARD

Many rural water co-ops don’t have paid employees, they run on volunteer time and skills. In these cases, the Board of Directors takes on both governance and operational duties. Many founding board members are used to handling member billing, paying invoices, digging trenches and conducting regular inspections.

This setup can work well when:

- Everyone understands who’s responsible for what

- The board keeps records and uses policies to guide decisions, and

- The group keeps looking ahead to build enough scale (and budget) to eventually hire help

Even when the Board has to be hands-on, they still must take on a role of stewardship. The Board has to make sure the day-to-day work is getting done, and that the water co-op can continue operating safely, fairly, and sustainably for its members.

GROWING INTO A GOVERNANCE BOARD

Water co-ops need to strive to move from being an operations board to a governance board by hiring part-time help, setting up better systems, or splitting duties more clearly between volunteers and contractors. That’s a good sign of progress.

Hiring an operations manager or bookkeeper does not take control away from the Board, it allows the Board more time to focus on the full picture and plan for the future. Sustainability and succession planning will require water co-op Boards to look at hiring help for the daily and long-term operations.

How do you move from being an operations Board to a governance Board?

- Document what you already do, and turn repeat tasks written procedures or policies (like maintenance schedules or member billing)

- Decide what can be delegated, and clarify roles and accountability for contractors or employees

- What does success look like?

- Who supervises the work?

- How often is it reported back to the Board?

- Start refocusing Board meetings to spend less time troubleshooting operations issues, and more time planning ahead and proactively developing or applying policies

THE BOARD’S CORE FINANCIAL DUTIES

The Board needs to understand how the financial position of the water co-op supports the mission and member service.

Whether your water co-op is large enough to have paid help, or if you’re running entirely on volunteer oversight, the Board’s responsibilities largely remain the same.

The Board’s financial responsibilities can be grouped into three main areas:

OVERSIGHT AND ACCOUNTABILITY

- Ensure financial records are complete, accurate, and up to date

- Review regular financial reports such as income statements, balance sheets and cash flow reports

- Review and approve annual financial statements before they go to the members

- Confirm that funds are being used in line with the water co-op’s approved budget, policies, and legal requirements

- Make sure required annual government filings are done on time, and ensure compliance with the Rural Utilities Act (Alberta) and any other reporting requirements

BUDGETING AND PLANNING

- Draft and approve an annual budget that aligns with operational needs and strategic plans

- Consider short-term costs and long-term investments, including reserve funds

- Anticipate and plan for seasonal or cyclical changes in revenue and expenses

RISK MANAGEMENT

- Identify and monitor potential financial risks

- Approve insurance coverage and review it annually

- Monitor cash flow to ensure the water co-op can meet obligations

SHARED VS INDIVIDUAL RESPONSIBILITIES

The Board may delegate certain financial tasks to staff, contractors, or the Treasurer, however, the legal and ethical responsibility stays with the Board as a whole.

SHARED RESPONSIBILITIES (THE WHOLE BOARD)

- Sets financial policies and approves budgets

- Reviews and questions financial statements regularly

- Ensures proper internal controls are in place

- Approves major capital expenditures and borrowing decisions

- Engages an auditor and reviews the auditor’s report

INDIVIDUAL RESPONSIBILITIES (EACH DIRECTOR)

- Reads financial reports before meetings and looks for trends and variances

- Asks respectful questions if something doesn’t make sense

- Speaks up early if something seems off or requires more clarification

- Stays informed between meetings if big changes or projects are happening

- Declares any conflict of interest before voting on financial matters

- Keeps financial information confidential unless disclosure is required by law

- Looks for and participates in financial training or orientation sessions offered by the AFRWC or other partners

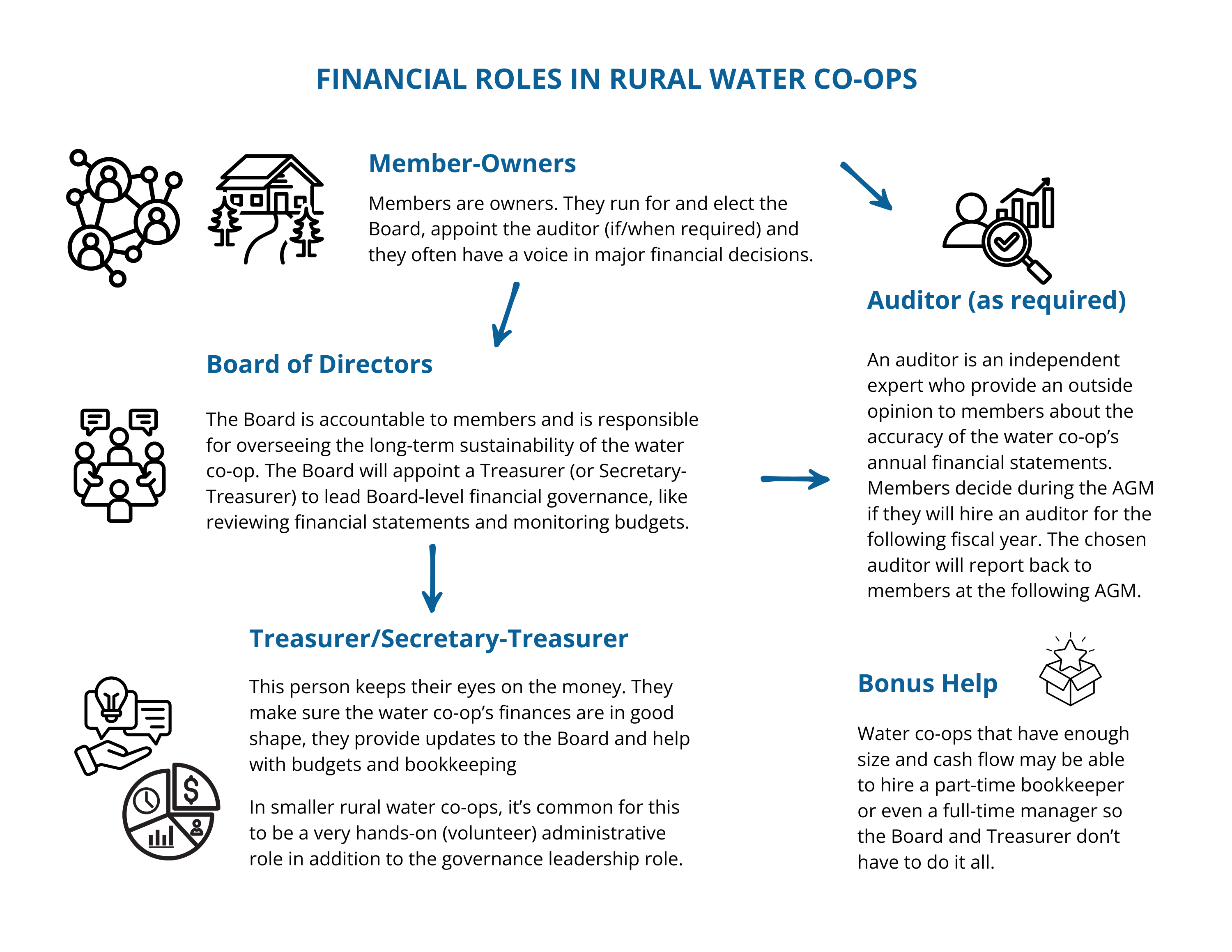

THE ROLE OF THE TREASURER

The Treasurer is meant to be a governance role, not an operational one.

In smaller rural water co-ops, Treasurers can get caught up doing the bookkeeping, but ideally, they would be the liaison between the Board and financial professionals (like an accountant, bookkeeper and auditor).

The Treasurer acts as the Board’s financial point person, but they are not solely responsible for the finances. They work closely with staff (if any) or volunteers to:

- Present regular financial reports in plain language to the Board

- Help prepare the draft budget for Board review and approval

- Ensure bills, invoices, payroll, and government filings are handled accurately and on time

- Monitor the water co-op’s cash flow and flag concerns early

- Support external financial reviews or audits if required

The Board will often call upon the Treasurer to present the financial reports to members and answer questions about the financial statements.

There is an information bulletin dedicated to the Role of the Treasurer that provides more detail for beginner Treasurers (or Secretary-Treasurers).

COMMITTEE WORK (WITH OR WITHOUT A COMMITTEE)

If a water co-op grows large enough, it may have a Finance Committee (or Finance, Audit and Risk Committee) to help prepare draft budgets, review financial reports in detail, and bring recommendations to the Boards.

In many small rural water co-ops, the Board itself acts as the committee. No committee does not mean less responsibility. In smaller water co-ops, all Directors share the responsibilities that a Finance Committee would handle.

If your Board operates without a Finance Committee, consider allotting more time in your Board agendas for detailed financial review, discussion and questions.

When needed, assign follow-up tasks to Board members or other volunteers to be completed between meetings (things like getting quotes or reviewing contracts).

Whether or not a formal committee exists, the key functions remain the same:

- Review Financial Reports in Detail. Go beyond glancing at the numbers; ask about variances from budget and unusual expenses.

- Prepare Budgets. Gather input from operations staff (if any), research expected costs, and discuss priorities.

- Support the Treasurer. Share the responsibility of understanding reports and being able to explain them to members.

BEST PRACTICE

Ensure Transparency Through Documentation. Keep clear records of financial decisions in meeting minutes so members can see how funds are managed. In the minutes, document who is assigned to follow-up on which items, and by when.

MEMBER FINANCIAL ACCOUNTABILITY

Members have a vital role in good financial governance of the water co-op too.

The water co-op can only operate with members paying their bills on time, participating in the AGM and any other special meetings, to review and approve the annual financial statements, and vote on major capital expenditures that improve the sustainability of the rural water system.

SAFEGUARDS AND INTERNAL CONTROLS

There is an information bulletin that dives deeper into internal controls and best practices of financially safeguarding your water co-op. These are simple things the water co-op can do to minimize the risk of mistakes, fraud, or overspending.

Examples of internal controls and safeguards include:

- Sharing (and separating) the Financial Responsibilities. The person who collects payments from members for example, should not be the only person reconciling the water co-op’s bank accounts.

- Keeping Paper Trails. It’s easier to have full financial transparency, when the water co-op keeps a good record of every payment, invoice, receipt and transaction.

Financial controls provide peace of mind for the Board and the members. The fewer surprises in the books, the more time your Board can spend focusing on members, projects, and planning for the future.

SUMMARY OF FINANCIAL GOVERNANCE

Stepping into financial governance might feel intimidating at first, but it’s one of the most empowering things about the co-operative way of running rural utilities. You don’t need to be an accountant, you just need to be willing to ask questions, pay attention, and remember that you’re looking out for your neighbours and fellow members.

Once you’re familiar with the rhythm, you’ll begin to better understand the story the numbers are telling about your water co-op’s well-being and future.

Every time you review a report, approve a budget, or present to members, you’re building your own confidence and strengthening your rural water co-op’s stability.

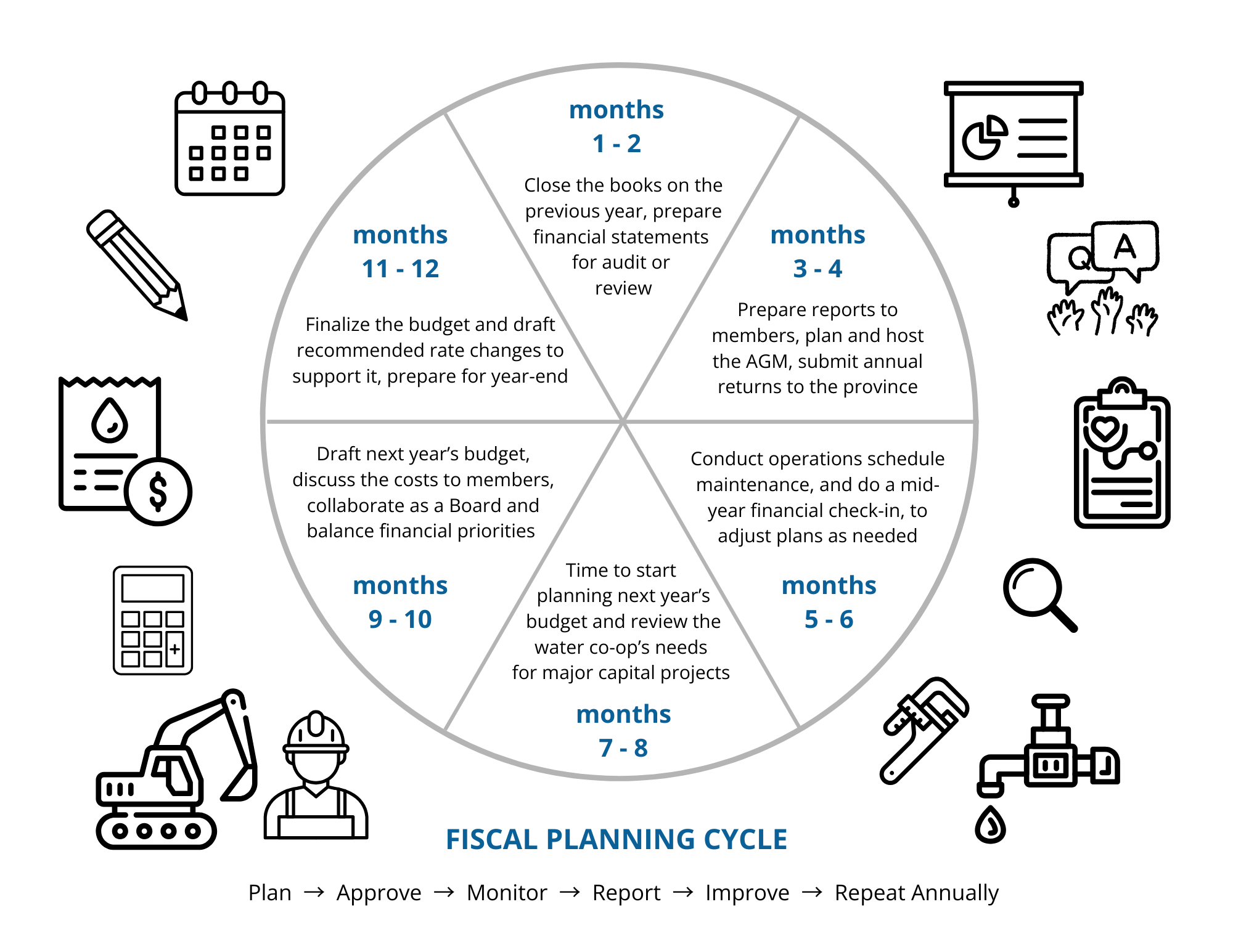

ANNUAL FINANCIAL CYCLE AT A GLANCE

It takes steady rhythm to run a financially healthy water co-op. The cycle is simple: The Board will move through planning, tracking and reporting responsibilities.

Your planning cycle will follow your fiscal year. For demonstration purposes, let’s say your fiscal year follows the January 1 - December 31 calendar year.

Budget Planning would begin many months before the start of a new fiscal year. Once the Board and Treasurer look ahead at the financial forecast of costs and revenues for the water co-op. The budget planning phase will consider what it will cost to maintain service levels and if there are any projects or expansions on the horizon.

Board Approval is required for the water co-op’s annual operating budget. The Treasurer may take the lead preparing the budget, however the full Board reviews, debates and approves the budget.

Quarterly Reviews should happen throughout the year. This is a quick check every few months to see how the water co-op is tracking against the budget. Are things going to plan? Are expenses in line? Are revenues where they should be?

Year-End, Audit and AGM is a busy time for any business. Within 120 days of your water co-op’s fiscal year-end, the financial statements need to be prepared and presented to members at the Annual General Meeting (AGM) for them to ask questions and approve the financial reports.

If your water co-op generates more than $100,000 in revenue or has more than $100,000 in reserve funds, the Board and/or Treasurer will need members approval to appoint an auditor. If the water co-op membership is not appointing an auditor, a motion should still be made at the AGM to waive the appointment of an auditor.

Annual Filings are a requirement of all water co-ops incorporated under the Rural Utilities Act of Alberta. Following your AGM (within about four months of year-end) the Board Secretary must submit to the Alberta Government’s Rural Utilities Director, a copy of the water co-op’s AGM notice to members, the AGM meeting minutes, the officer’s list (of who sits on the Board), the financial statements (audited if available) and a copy of any new supplemental bylaws (if there were any).

Tip: Keeping a simple checklist of these milestones each year helps ensure nothing is missed during transitions between volunteer Boards.